Financial Technology Write For Us

Financial technology is and innovation designed to compete with traditional economic methods in the provision of financial services. It is a growing industry that uses technology to improve financial performance. The use of smartphones for mobile finance, investment, lending, and cryptocurrency are examples of technologies to make financial services more nearby to the general public. Fintech companies are made up of startups and established financial institutions and technology companies trying to replace or improve the use of financial services by existing financial companies.

Financial technology is and innovation designed to compete with traditional economic methods in the provision of financial services. It is a growing industry that uses technology to improve financial performance. The use of smartphones for mobile finance, investment, lending, and cryptocurrency are examples of technologies to make financial services more nearby to the general public. Fintech companies are made up of startups and established financial institutions and technology companies trying to replace or improve the use of financial services by existing financial companies.

Understanding Fintech

In general, the term fintech can be applied to any innovation in the way people do business, from the invention of digital currency to double-entry accounting. However, after the Internet revolution and the Internet revolution for mobile devices and smartphones, financial technology has experienced explosive growth, and fintech, which originally referred to computer technology used to run banks or commercial companies, now describes many technological interventions in privacy. Domain. And corporate finance.

FinTech today describes various financial transactions such as transferring money, depositing a check on your smartphone, skipping a bank branch to apply for a loan, raising funds for a new business, or managing your investments, usually without human assistance. According to the FinTech Adoption Index 2017, a third of consumers use at least two fintech services, and these consumers are also aware of fintech in their daily lives.

Key Ideas

FinTech refers to integrating technology into the offerings of financial services companies to improve their use and delivery to consumers.

It works by breaking up what these companies have to offer and creating new markets for them. Startups are grabbing the financial industry’s attention by expanding access to financial services and using technology to lower operating costs.

Fintech In Practice

The most talked-about (and most funded) fintech startups share the same trait: They are built to threaten, challenge, and ultimately defeat established traditional financial service providers by being more flexible, serving an underserved segment, or delivering services quickly. And fast. Get well.

Examples Of Fintech Companies

For example, Affirm, a fintech company in the United States, seeks to exclude credit card companies from the online shopping process by offering consumers the option of getting short-term instant credit for their purchases. While interest rates can be high, Affirm claims to provide consumers with low or no creditworthiness a way to get credit and build their credit history. Likewise, Better Mortgage aims to streamline the mortgage process (and stay away from traditional mortgage brokers) with a fully digital offering that rewards users with a validated email with pre-approval within 24 hours or later. And also, Need. Green Sky is committed to connecting home renovation borrowers with banks and helping consumers avoid lender dead ends and save on interest by offering periods of interest-free promotions.

Fintech And New Technologies

New technologies such as machine learning / artificial intelligence, predictive behavioral analytics, and data-driven marketing will eliminate guesswork and financial decision-making habits. “Learning” applications not only learn user habits, which are often hidden from themselves but also include them in learning games to improve their automatic and unconscious results and record decisions. Fintech is also an excellent adapter for automated customer service technology, which uses chatbots and artificial intelligence interfaces to help customers with basic tasks and reduce staff costs.

Fintech Landscape

Funding for fintech startups in 2016 totaled $ 17.4 billion. By the end of 2017, they should have exceeded that amount, according to CB Insights, for 26 fintech unicorns with a total value of $ 83.8 billion worldwide. Therefore, same company reported that 39 fintech unicorns were supported at the end of 2018, valued at $ 147.37 billion.

Most of all, fintech startups are produced by North America, Asia is in second place. And also, In the first quarter of 2018, global finance for fintech hit a new record with a significant increase in transactions in North America. Asia, which could outperform the US in fintech operations, is also seeing increased inactivity. Financial activity in Europe was the lowest in five quarters in the first quarter of 2018 but raised in the second quarter.

How to Submit Your Articles

For Submitting Your Articles, you can email us contact@imtechies.com

Why Write For – Imtechies Financial Technology Write for Us

Search Terms Related to Financial Technology Write For Us

Mobile banking

Complementary financial services

Financial industry

Risk management

Open banking

Currency exchange

Financial adviser

Exit of Britain from the European Union.

Indonesia

Venture capital

Big data

Robotic process automation

Blockchain.

United Kingdom

New York City

International Monetary Fund

Bank Secrecy Act

Office of the Comptroller of the Currency

World Economic Forum

Search Terms for Financial Technology Write For Us

write for us

looking for guest posts

guest posting guidelines

become a guest blogger

guest post

becomes an author

suggest a post

contributor guidelines

guest posts wanted

submit an article

writers wanted

guest posts wanted

submit the post

contributing writer

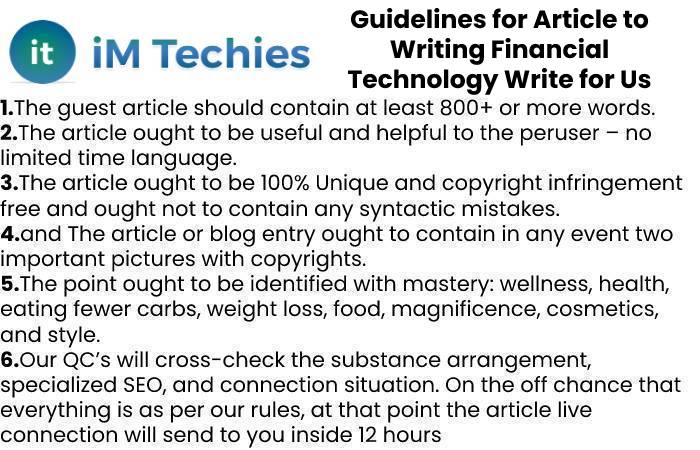

Guidelines for Article to Writing Financial Technology Write for Us

For Submitting Your Articles, you can email us contact@imtechies.com