Table of Contents

What Is Double Entry?

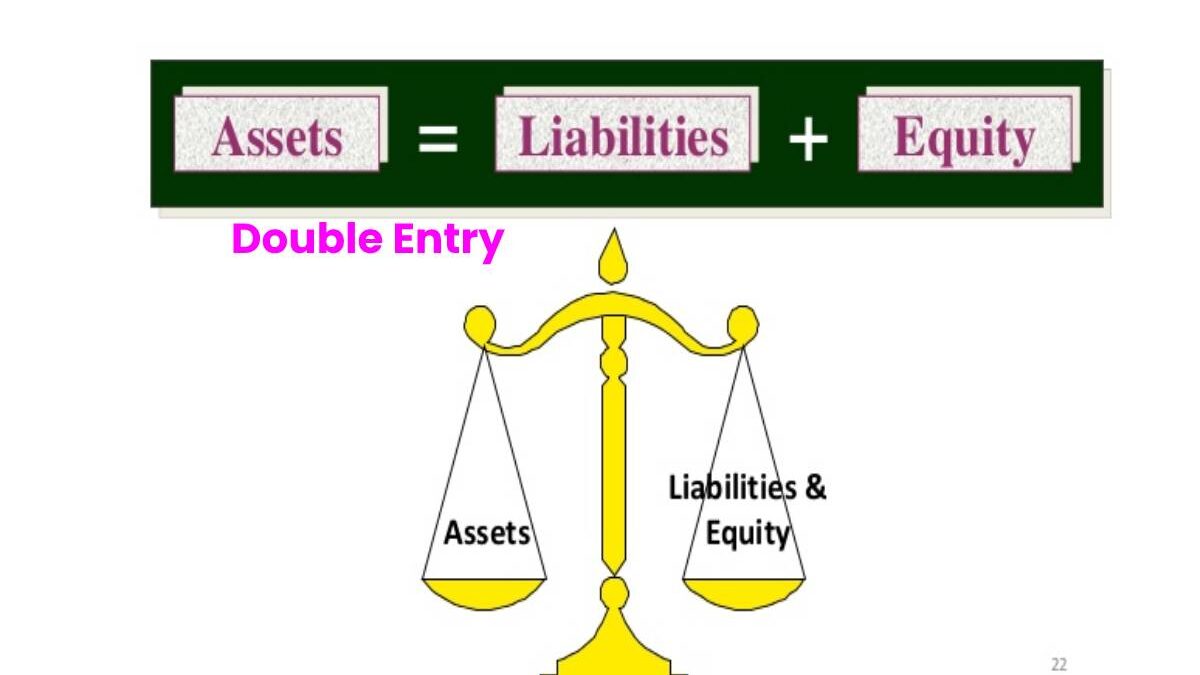

A fundamental concept underlying present-day bookkeeping and accounting is Double entry, which states every financial transaction has equal and opposite effects in at least two different accounts. It is used to satisfy the accounting equation:

- Assets=Liabilities+Equity

With a double-entry system, credits are offset by debits in a general ledger or T-account.

The Basics of Double Entry

In the double-entry system, transactions record in terms of debits and credits. Since a debit in one account offsets a credit, the sum of all debits must equal the sum of all recognition.

The double-entry system of bookkeeping standardizes the accounting process and improves the accuracy of prepared financial statements, allowing for improved detection of errors.

Types of Double Entry Accounts

Bookkeeping and accounting measure, record, and communicate a firm’s financial information. A business transaction is an economic event that is recorded for accounting/bookkeeping purposes. In general terms, it is a business interaction between economic entities, such as customers and businesses or vendors and businesses.

Under the systematic process of accounting, these interactions generally classify into accounts. There are seven different types of accounts that all business transactions can be classified:

- Assets

- Liabilities

- Equities

- Revenue

- Expenses

- Gains

- Losses

- Bookkeeping and accounting track changes in each account as a company continues operations.

Real-World Example of Double Entry

- A bakery purchases a fleet of refrigerated delivery trucks on credit; the total credit purchase was $250,000.

- The new set of trucks will be used in business operations and will not be sold for at least ten years—their estimated useful life.

- To account for the credit purchase, entries must make in their respective accounting ledgers.

- Because the business has accumulated more assets, a debit to the asset account for the purchase cost ($250,000) will make.

- And also, credit entry of $250,000 will make notes payable to account for the credit purchase.

- The debit entry increases the asset balance, and the credit entry increases the notes payable liability balance by the same amount.

- Double entries can also occur within the same class.

- If the bakery’s purchase makes cash, a credit would be made to money and a debit to an asset, still resulting in a balance.

Debits and Credits of Double Entry

- Debits and credits are essential to the double-entry system. In accounting, debit refers to an entry on the left side of an account ledger, and credit refers to an entry on the right side of an account ledger.

- To be in balance, the total of debits and recognition for a transaction must be equal. Debits do not always equate to increases, and credits do not always equate to decreases.

- A debit may increase one account while decreasing another. For example, a debit increases asset accounts but reduces liability and equity accounts, supporting the general accounting equation of Assets = Liabilities + Equity.

- On the income statement, debits increase the balances in expense and loss accounts, while credits decrease their balances.

- Debits decrease revenue and gains account balances, while credits increase their balances.

The Double-Entry Accounting System

- Double-entry bookkeeping was developed in the mercantile period of Europe to help rationalize commercial transactions and make trade more efficient.

- It also helped merchants and bankers understand their costs and profits. Some thinkers have argued that accounting was a critical calculative technology responsible for the birth of capitalism.

- The accounting equation forms the foundation of double-entry accounting. It is a concise representation of a concept that expands into the complex, augmented, and multi-item balance sheet display.

- The balance sheet is based on the accounting system, where a company’s total assets are equal to its total liabilities and shareholder equity.

- Essentially, the representation equates all uses of capital (assets) to all sources of capital (where debt capital leads to liabilities and equity capital leads to shareholders’ equity).

- Every business transaction will represent two versions for a company to keep accurate accounts.

- For instance, if a business takes a loan from a financial entity like a bank, the borrowed money will raise the company’s assets, and the loan liability will also rise by an equivalent amount.

- If a business buys raw materials by paying cash, it will increase the inventory (asset) while reducing cash capital (another purchase).

- The accounting system refers to accounting because every transaction a company makes affects two or more accounts.

- It ensures practice that the accounting equation continuously remains balanced – that is, the left side value of the equation will always match the correct side value.

Conclusion

Double-entry refers to an accounting concept whereby assets = liabilities + owners’ equity. In the double-entry system, transactions record in terms of debits and credits.

Double-entry bookkeeping was developed in the mercantilEurope’s mercantilepersonalizee commercial transactions andmadee trade more efficient. Theemergences emergence is linkedtof capitalism.

Also Read: Startup First Office – Definition, How To Set Up, and More